GSTR 3B Quarterly Return: Filing, Due Date and Penalty

- 20 Sep 24

- 11 mins

GSTR 3B Quarterly Return: Filing, Due Date and Penalty

Key Takeaways

- Quarterly Filing Ease: The QRMP scheme simplifies GST compliance by allowing small taxpayers to file returns quarterly.

- Timely ITC with IFF: Use the Invoice Furnishing Facility (IFF) to ensure timely Input Tax Credit (ITC) for recipients.

- FSM vs. SAM: Choose Fixed Sum Method (FSM) for simplicity or Self-Assessment Method (SAM) for accuracy in tax payments.

- Switch Filing Frequency: Easily switch from quarterly to monthly filing at the end of any quarter if needed.

- Penalties for Late Filing: Avoid interest and late fees by adhering to GSTR-3B and IFF deadlines.

If you're a small taxpayer navigating the complexities of GST filing, you're in the right place. This guide will walk you through the quarterly filing of GSTR-3B, a simpler method for eligible taxpayers. Let's dive into the details!

What is GSTR-3B?

The GST Council introduced the summary return form GSTR-3B for taxpayers to declare their condensed GST liabilities for the tax period. It's a self-declared summary GST return that simplifies the filing process and ensures timely payment of tax.

- Purpose: The primary aim of GSTR-3B is to streamline the process of tax payment and ensure that taxes are paid on time. This form does not require invoice-level details, making it quicker and easier to file.

- Content: It includes details such as total sales, taxable value, tax liability, and the amount of ITC claimed. Taxpayers must also report any interest and late fees payable.

- Frequency: While it is a monthly return, small taxpayers with an annual turnover up to INR 5 crores can opt for the Quarterly Return filing and Monthly Payment of taxes (QRMP) scheme, allowing them to file GSTR-3B quarterly instead.

- Deadline: For monthly filers, GSTR-3B must be filed by the 20th of the following month. For quarterly filers under the QRMP scheme, the due date is either the 22nd or 24th of the month following the quarter, depending on the state.

Who can opt for quarterly filing?

Eligibility Criteria

Small taxpayers with an aggregate turnover of up to INR 5 crores in the preceding financial year can opt for the Quarterly Return filing and Monthly Payment of Taxes (QRMP) scheme. This scheme allows for the quarterly filing of GSTR-3B with the convenience of monthly tax payments.

How to opt for quarterly filing?

This process will enable you to switch to quarterly filing of GSTR-3B under the QRMP scheme.

Step-by-Step Guide

Step 1: Log in to the GST Portal: Access your account on the GST portal.

Step 2: Navigate to the Opt-In Section: Go to 'Services', then 'Returns', and click on 'Opt-in for Quarterly Return'.

Step 3: Select Financial Year: Choose the applicable financial year.

Step 4: Choose Quarterly Option: Select the 'Quarterly' filing option.

Step 5: Submit and Save: Submit your choice and save the acknowledgment for your records.

Invoice Furnishing Facility (IFF)

What is IFF?

The Invoice Furnishing Facility (IFF) is a feature under the GST system that allows taxpayers to provide details of their outward supplies (sales) for the first two months of a quarter. This is especially useful for those who have opted for the Quarterly Return filing and Monthly Payment of taxes (QRMP) scheme.

Benefits of Using IFF

- Timely Credit for Recipients: IFF ensures that recipients receive timely credit for the supplies, which helps them manage their finances better.

- Easier Compliance: It allows taxpayers to comply with monthly filing requirements, even though they are on a quarterly return cycle.

- Reduced Filing Burden: By submitting sales details monthly, taxpayers avoid the hassle of compiling three months' worth of invoices at the end of the quarter.

Methods of Making Payment

Overview of Payment Methods

Taxpayers have several options to make their GST payments, ensuring flexibility and convenience. Here are the primary methods available:

- Internet Banking: This is the most common and convenient method. Taxpayers can log in to their bank's online portal and make the payment directly from their bank account. It provides real-time confirmation and is available 24/7.

- Debit/Credit Cards: Payments can be made using any major debit or credit card. This method is quick and easy, allowing taxpayers to use their card's payment facilities to settle their GST liabilities.

- NEFT/RTGS: National Electronic Funds Transfer (NEFT) and Real-Time Gross Settlement (RTGS) are electronic payment systems used for transferring funds between banks. Taxpayers can use these systems to transfer the payment from their bank account to their GST account. NEFT is typically used for smaller amounts, while RTGS is used for larger transactions.

- Over-the-Counter (OTC) Payment at Authorized Banks: For those who prefer traditional methods, payments can be made in person at authorized bank branches. Registered Taxpayers need to generate a challan from the GST portal, which they can then present at the bank to make the payment in cash, cheque, or demand draft.

How to declare B2C supplies in IFF for the first two months of the quarter?

Detailed Instructions

To declare B2C supplies in the Invoice Furnishing Facility (IFF), follow these steps:

Step 1: Log in to the GST Portal: Access your account on the GST portal.

Step 2: Navigate to IFF: Go to 'Services', then 'Returns', and select 'IFF'.

Step 3: Select Tax Period: Choose the relevant tax period for which you want to declare B2C supplies.

Step 3: Enter B2C Supply Details: Input the details of your B2C (business-to-consumer) supplies for the selected period.

Step 4: Save and Submit: Save the entered details and submit the information to complete the process.

How to opt for the QRMP Scheme?

Step-by-Step Guide

- Access the GST Portal: Start by logging into your account on the GST portal using your credentials.

- Navigate to the Opt-In Section:

- Once logged in, go to the top menu and click on 'Services'.

- From the dropdown, select 'Returns'.

- Under the 'Returns' section, click on 'Opt-in for Quarterly Return'.

- Choose the Desired Financial Year:

- You will be prompted to select the financial year for which you want to opt for the QRMP scheme.

- Carefully choose the appropriate financial year from the list provided.

- Select the Quarterly Option:

- After selecting the financial year, you will see an option to choose the frequency of return filing.

- Select the 'Quarterly' option to opt for the QRMP scheme.

- Confirm Your Choice and Save the Acknowledgment:

- Review your selection to ensure everything is correct.

- Confirm your choice by clicking the submit button.

- For your records, save the acknowledgment receipt that the system generates. This receipt serves as proof that you have successfully opted for the QRMP scheme.

Following these steps will allow you to switch to the Quarterly Return filing and Monthly Payment of taxes (QRMP) scheme, making your GST compliance process more manageable.

Is it Possible to Opt Out of QRMP Scheme? If So, When?

Process and Timing

Yes, you can opt out of the QRMP scheme at the end of any quarter. Here's how to do it:

- Log in to the GST Portal: Access your account using your credentials.

- Navigate to Opt-In Section:

- Go to 'Services'.

- Select 'Returns'.

- Click on 'Opt-in for Quarterly Return'.

- Change Filing Preference:

- Select the applicable financial year.

- Change your filing preference from 'Quarterly' to 'Monthly'.

- Confirm and Save:

- Confirm your choice.

- Save the acknowledgment for your records.

How to claim ITC for the first two months of the quarter?

Instructions for Claiming ITC

To claim Input Tax Credit (ITC) for the first two months of the quarter, follow these steps:

- Utilize the Invoice Furnishing Facility (IFF):

- Access the GST portal and navigate to 'Services' > 'Returns' > 'IFF'.

- Upload your invoices for the first two months of the quarter using the IFF.

- Ensure Supplier Compliance:

- Make sure your suppliers have also uploaded their invoices. This is crucial for accurate auto-population of ITC details in your returns.

- Cross-Check ITC Details:

- Check the auto-populated ITC details in your GSTR-2A and GSTR-2B forms. Verify that all eligible credits are accurately reflected.

- Claim ITC in Quarterly GSTR-3B Return:

- When filing your quarterly GSTR-3B return, include the ITC claimed for the first two months based on the verified details from GSTR-2A and GSTR-2B.

What Should I Do if I Have Not Filed IFF for the First Two Months of the Quarter?

If you haven't filed the Invoice Furnishing Facility (IFF) for the first two months:

- Include Invoice Details in Quarterly GSTR-3B Filing:

- Add the missed invoice details directly in your quarterly GSTR-3B return.

- Inform Recipients:

- Notify your recipients that there may be a delay in claiming their Input Tax Credit (ITC).

- Ensure Timely Filing:

- Commit to filing IFF on time in the future to prevent delays and compliance issues.

This approach helps maintain compliance and minimizes disruptions for both you and your recipients.

Can I File IFF After the 13th of the Following Month?

Deadlines and Consequences

No, you cannot file the Invoice Furnishing Facility (IFF) after the 13th of the following month. Missing this deadline means:

- Include Invoices in Quarterly GSTR-3B:

- You will need to include the missed invoices in your quarterly GSTR-3B return.

- Delayed ITC for Recipients:

- Your recipients might face delays in claiming their Input Tax Credit (ITC) for that period.

How should taxpayers pay taxes if they have chosen quarterly filing of returns?

Payment Guidelines

Taxpayers who opt for quarterly filing must pay their taxes monthly using one of the following methods:

- Fixed Sum Method (FSM): Pay 35% of the tax paid in the previous quarter (if filed quarterly) or the last month of the previous quarter (if filed monthly).

- Self-Assessment Method (SAM): Pay the actual tax due for the month based on the tax liability.

The taxpayers can pay their monthly tax liability either in the Fixed Sum Method (FSM) also known as 35% challan method, or Self Assessment Method (SAM).

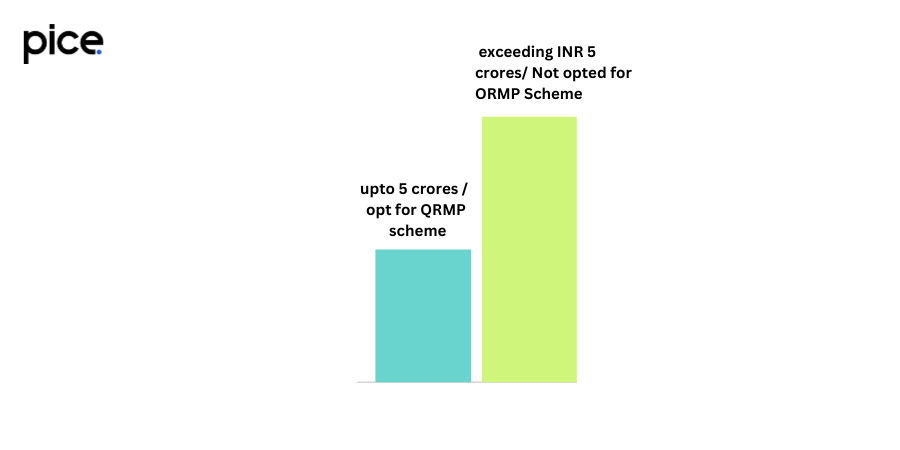

What deems monthly or quarterly filing of GSTR-3B?

Criteria and Differences

- Monthly Filing: Taxpayers with an annual turnover exceeding INR 5 crores or those who do not opt for the QRMP scheme.

- Quarterly Filing: Taxpayers with an annual turnover up to INR 5 crores who opt for the QRMP scheme.

Quarterly GSTR 3B due date

Important Dates and Deadlines

- Monthly Filing: 20th of the following month.

- Quarterly Filing: 22nd or 24th of the month following the quarter (depending on the state).

The late filing of GSTR-3B attracts a late fee and interest at 18% per annum.

Conclusion

Opting for the QRMP scheme and filing GSTR-3B quarterly can significantly ease the compliance burden for small taxpayers. It offers flexibility, reduces paperwork, and ensures timely tax payments. By understanding the process, benefits, and deadlines, small taxpayers can effectively manage their GST obligations.

💡Learn more about how our Pice can help you make all your important business payments, like supplier and vendor payments, rent, GST, & utility, from one single dashboard with your credit card. Request a demo now.

By

By