Differences Between HSN Code & SAC Code

- 20 Sep 24

- 10 mins

Differences Between HSN Code & SAC Code

Key Takeaways

- HSN codes provide a standardized method for classifying goods, using a 6-digit or 8-digit number to ensure accurate tax calculation and compliance with GST regulations.

- SAC codes are essential for classifying services under GST, helping service providers apply the applicable rate and maintain consistent taxation.

- The systematic structure of HSN codes facilitates international trade by providing a common language for identifying products.

- Proper use of HSN and SAC codes simplifies GST return filing and aids in accurate tax reporting for both goods and services.

- Both HSN and SAC codes play a crucial role in avoiding misclassification, ensuring businesses adhere to GST regulations and avoid penalties.

What is an HSN Code?

The HSN (Harmonized System of Nomenclature) code is an internationally accepted system for classifying goods. It is a standardized numerical method developed by the World Customs Organization (WCO) to ensure uniform classification of products across international trade. These codes are used by Indian manufacturers and businesses to systematically categorize goods for taxation purposes, ensuring accurate classification and compliance with GST regulations.

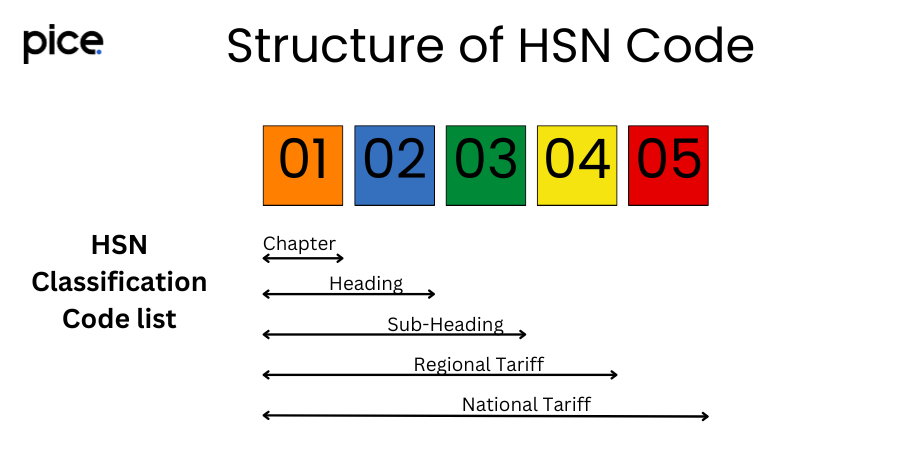

These codes consist of a series of numbers that break down the product classification into sections, chapters, headings, and subheadings. For example, a product code might begin with a two-digit HSN number representing a broad category, followed by a more specific 4-digit number and ultimately an 8-digit code for precise identification. This logical structure allows for systematic classification and facilitates international trade by providing a common language for identifying products.

The use of HSN in India aids in the accurate calculation of taxes, including the applicable GST rate for various goods. By employing this standardized system, businesses can ensure their invoice generation processes align with global practices, enhancing transparency and compliance with GST regulations.

What is an SAC Code?

Service Accounting Codes (SAC) are used to classify services under the GST regime in India. Similar to HSN codes for goods, SAC codes provide a standardized method for the classification of services, which is crucial for tax collection and compliance. These codes are particularly important for service providers, including those involved in construction services, legal services, and a wide range of other service categories.

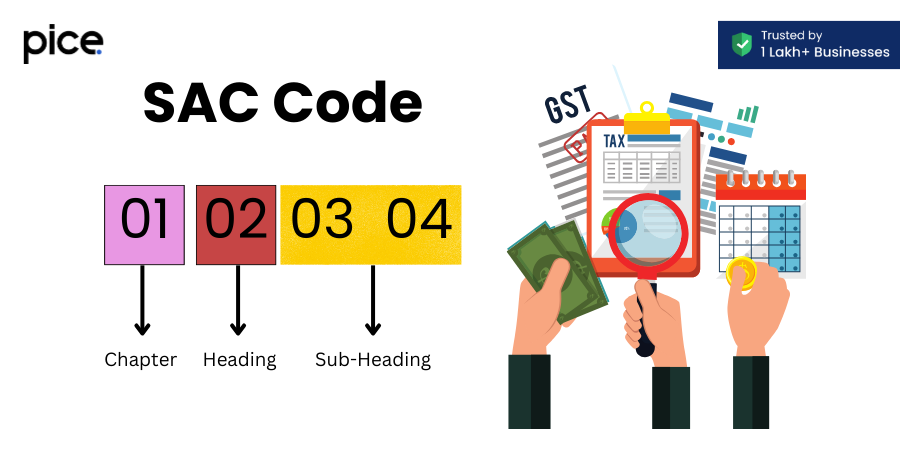

SAC codes consist of a series of digits (6-Digit Number) that categorize services into major service categories and specific service natures. This classification is essential for determining the applicable GST rate for various services, ensuring accurate tax collection and compliance with GST regulations. For example, services related to buildings or construction services have specific SAC codes that dictate their tax treatment.

💡 If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses.

The implementation of SAC codes ensures uniform classification and simplifies the tax filing process for service providers. By using these codes, businesses can accurately classify their services, streamline their GST return filing processes, and ensure compliance with GST regulations.

How Does the HSN Code Work?

It work by providing a detailed and structured classification of goods. The system starts with a broad categorization and narrows down to specific items, allowing for precise identification of products. This hierarchical structure consists of sections, chapters, headings, and subheadings, each represented by a specific number of digits.

The Importance of HSN Codes

The importance of HSN codes lies in their ability to facilitate international trade and ensure accurate tax calculation. For businesses, using HSN codes ensures compliance with GST regulations and helps avoid penalties related to misclassification. HSN codes also play a crucial role in optimizing Input Tax Credit (ITC) by ensuring that taxes are accurately recorded and credited throughout the supply chain.

In international trade, HSN codes provide a common language for identifying products, reducing ambiguities and simplifying the customs process. This standardized system allows Indian manufacturers to compete globally by adhering to internationally recognized product classifications.

What is the Use of SAC Codes in GST?

SAC codes are used to classify services for taxation under the GST regime. They provide a standardized method for identifying the nature of services, ensuring accurate tax calculation and compliance. SAC codes are crucial for determining the applicable GST rate for various services, which can vary significantly based on the type of service provided.

For service providers, using SAC codes simplifies the GST return filing process by providing a clear framework for classifying services. This classification is essential for ensuring accurate tax collection and avoiding legal issues related to misclassification. For example, services of buildings and construction services have specific SAC codes that must be used for proper tax treatment.

SAC codes also facilitate compliance with GST regulations by providing a consistent method for categorizing services. This consistency helps businesses maintain accurate records and ensures that tax liabilities are correctly reported and paid.

Understanding the Use of HSN Codes in India

In India, HSN codes are used extensively for the classification of goods under the GST regime. This system ensures that products are uniformly classified, aiding in accurate tax calculation and compliance. Indian manufacturers and businesses must use HSN codes to categorize their products correctly, ensuring that the appropriate GST rate is applied.

The use of HSN codes in India is mandated for businesses with an annual turnover above a specified threshold. This requirement helps in maintaining a systematic classification of goods, facilitating easier compliance with GST regulations and smoother GST return filing. By using HSN codes, businesses can avoid issues related to incorrect tax rates and misclassification, which can lead to penalties and legal consequences.

HSN codes also aid in invoice generation, providing a clear and consistent method for detailing product descriptions and tax rates on invoices. This consistency is crucial for both domestic transactions and international trade, ensuring that products are accurately classified and taxed according to their specific categories.

How to Determine the HSN Code for a Product

Determining the HSN codes for services or product involves a systematic process of classification. This process ensures that products are accurately categorized, facilitating proper tax treatment and compliance with GST regulations.

Identifying the Section

The first step in determining the HSN code is identifying the broad section to which the product belongs. HSN codes start with a two-digit number representing a broad category of goods. For example, textiles, machinery, and chemicals each have their own sections within the HSN framework.

Narrowing Down the Subheading

Once the section is identified, the next step is to narrow down the subheading. This involves using a four-digit HSN number that provides a more specific classification within the section. This step helps in further detailing the product category, ensuring accurate classification.

Obtaining the Complete HSN Code

The final step is to obtain the complete HSN code, which may include an eight-digit code for precise identification. This detailed nature of the HSN code ensures that products are accurately classified, allowing for proper tax calculation and compliance. The complete HSN code provides a comprehensive classification that aids in international trade and GST compliance.

SAC Code Format in GST

SAC codes follow a structured format similar to HSN codes but are specifically designed for services. These codes provide a standardized method for classifying services under the GST regime, ensuring accurate tax calculation and compliance.

Identifying the Chapter: The first step in understanding SAC codes is identifying the relevant chapter. Chapters in SAC codes represent broad service categories, such as construction services, legal services, and other professional services. Each chapter is designated by a specific number, providing a clear classification framework.

Major Service Categories: Within each chapter, SAC codes further classify services into major service categories. These categories represent specific types of services, such as consulting, maintenance, and repair services. This classification helps in determining the applicable GST rate and ensuring accurate tax calculation.

Specific Service Nature: The final step in the SAC code format is identifying the specific nature of the service. This involves using detailed codes that precisely categorize the service provided. For example, services of buildings and construction services have distinct SAC codes that detail the specific nature of the service, ensuring proper tax treatment.

Utilization of SAC Codes in GST

SAC codes are utilized in GST to ensure accurate classification and tax calculation for services. Service providers must use the appropriate SAC codes when issuing invoices and filing GST returns, ensuring compliance with GST regulations. This classification is essential for determining the applicable GST rate and avoiding issues related to misclassification.

SAC codes also facilitate business compliance by providing a clear framework for categorizing services. This framework helps businesses maintain accurate records, streamline their GST return filing processes, and ensure that tax liabilities are correctly reported and paid. By using SAC codes, service providers can avoid penalties and legal issues related to incorrect tax classification.

Differences Between HSN Codes and SAC Codes

The primary difference between HSN codes and SAC codes lies in their application. HSN codes are used for the classification of goods, while SAC codes are used for the classification of services. Both systems provide a standardized method for categorizing products and services, ensuring accurate tax calculation and compliance with GST regulations.

HSN codes follow a numerical structure that categorizes goods into sections, chapters, headings, and subheadings. This hierarchical classification facilitates international trade and ensures uniform classification of products. SAC codes, on the other hand, follow a similar numerical structure but are designed specifically for services, categorizing them into chapters, major service categories, and specific service natures.

Both HSN and SAC codes play a crucial role in GST compliance, helping businesses accurately classify their products and services, determine the applicable GST tax rate, and avoid issues related to misclassification. Understanding these differences is essential for businesses to ensure proper tax treatment and compliance with GST regulations.

By

By