How to Claim ITC Refund on Cancellation of GST Registration

- 20 Sep 24

- 12 mins

How to Claim ITC Refund on Cancellation of GST Registration

Key Takeaways

- Complete Documentation: Submit all necessary documents and declarations, including FORM GST RFD-01, accurately on the GST portal.

- Satisfactory Verification: Ensure no discrepancies in the application for a positive verification report from tax authorities.

- No Outstanding Dues: Clear all pending taxes and comply with GST return filings before applying for a refund.

- Reversal of ITC: Reverse unutilized ITC on closing stock in the final return (GSTR-10) filed within three months of cancellation.

- Timely Refund Application: Submit Form RFD-01 promptly and follow up on the verification process for timely refund approval.

Cancellation of GST registration can occur for various reasons, such as business discontinuation, transfer of business, or the death of the sole proprietor. When a GST registration is cancelled, the registered person is required to settle any pending liabilities and can also claim a refund for any unutilized Input Tax Credit (ITC).

This blog provides a comprehensive guide on how to claim an ITC refund on the cancellation of GST registration.

What is the Cancellation of GST Registration?

Cancellation of GST registration refers to the termination of the registration of a taxpayer under GST law. It can be initiated either by the taxpayer voluntarily, by the tax authorities due to certain defaults, or by legal provisions when a business is no longer operational.

Understanding the Cancellation of Registration

A registered person can apply for the cancellation of GST registration through the GST portal. The reasons for cancellation can include:

- Business Discontinuation: The business has ceased operations.

- Transfer of Business: The business has been transferred fully due to a sale, merger, or other reasons.

- Change in Constitution: Changes such as the conversion of a proprietorship into a partnership or vice versa.

- Death of Sole Proprietor: The death of the sole proprietor leading to the cessation of business operations.

What are the Consequences of GST Registration Cancellation?

Cancellation of GST registration has several significant consequences that a taxpayer must be aware of.

1. Discharge of Liabilities

Upon cancellation of GST registration, the taxpayer must discharge all liabilities. This includes:

- Reversal of ITC on Closing Stock: The taxpayer must reverse the ITC on the closing stock, including inputs, semi-finished goods, and finished goods.

- Pending Tax Payments: All pending tax liabilities must be settled, and any dues must be cleared before the final return is filed.

2. Return Filing

The taxpayer must file a final return (GSTR-10) within three months from the date of cancellation. This return must include:

- Details of Supplies Made: Information about the supplies made before the cancellation.

- Reversal of ITC: The reversal of any unutilized ITC in the electronic credit ledger.

- Discharge of Liabilities: Confirmation that all tax liabilities have been settled.

3. Reversal of ITC

Any unutilized ITC in the electronic credit ledger must be reversed. This means:

- Adjustment in Final Return: The reversal should be adjusted in the final return (GSTR-10).

- Impact on Cash Flow: The reversal of ITC may impact the taxpayer's cash flow as they can no longer utilize this credit.

4. No Business Operations

Once the GST registration is cancelled:

- Cease Business Operations: The taxpayer cannot continue business operations under GST.

- No GST Invoices: The taxpayer cannot issue GST invoices or collect GST from customers.

- Compliance Issues: Continuing business operations without a valid GST registration can lead to penalties and compliance issues.

5. Refund Claims

The taxpayer might be eligible to claim accumulated ITC refunds under certain conditions. This includes:

- Refund Application: Filing a refund application in Form RFD-01.

- Refund Processing Officer: The refund processing officer will verify and process the claim.

- Conditions for Refund: Refunds are subject to conditions specified under GST law.

6. Revocation of Cancellation

In certain cases, a taxpayer can apply for the revocation of the cancellation of GST registration. This involves:

- Application for Revocation: Filing an application for revocation in Form GST REG-21.

- Time Limit: The application must be submitted within 30 days from the date of the cancellation order.

- Review by Authorities: The tax authorities will review the application and may approve or reject the revocation.

In case of Voluntary registration under GST, application for cancellation can be made only after one year from the date of registration.

Types of Refunds

When a GST registration is cancelled, the registered person can claim a refund for:

- Unutilized Input Tax Credit (ITC): ITC accumulated due to the inward supply of goods or services.

- Excess Balance in Electronic Cash Ledger: Any surplus balance in the electronic cash ledger after settling liabilities.

Cases under which Refund of Accumulated ITC is Allowed

Refund of accumulated Input Tax Credit (ITC) is allowed under the Goods and Services Tax (GST) in the following cases:

1. Export of Goods/Services

- Zero-Rated Supplies: When goods or services are exported, they are considered zero-rated supplies. This means that no GST is charged on the export, but the exporter is entitled to claim a refund of the accumulated ITC. This is applicable whether the export is made without payment of tax under a Bond or Letter of Undertaking (LUT).

2. Inverted Tax Structure

- Inverted Tax Structure: This occurs when the rate of tax on inputs (purchases) is higher than the rate of tax on output supplies (sales). For example, if a manufacturer purchases raw materials at a GST rate of 18% and sells the finished goods at a GST rate of 12%, the accumulated ITC due to the higher input tax rate can be claimed as a refund.

Time Limit and Frequency for Claiming Refund of Accumulated ITC

- Two Years from Relevant Date: The application for refund of accumulated Input Tax Credit (ITC) must be filed within two years from the relevant date. The relevant date can vary depending on the nature of the supply, such as the date of export for zero-rated supplies or the date of payment of tax for other cases.

Frequency for Claiming Refund

- Monthly/Quarterly Refund Applications:

- Taxpayers can file refund claims on a monthly or quarterly basis, aligning with their GST return filing frequency (GSTR-1 and GSTR-3B).

- Monthly filers can submit refund applications monthly, while quarterly filers can do so at the end of each quarter.

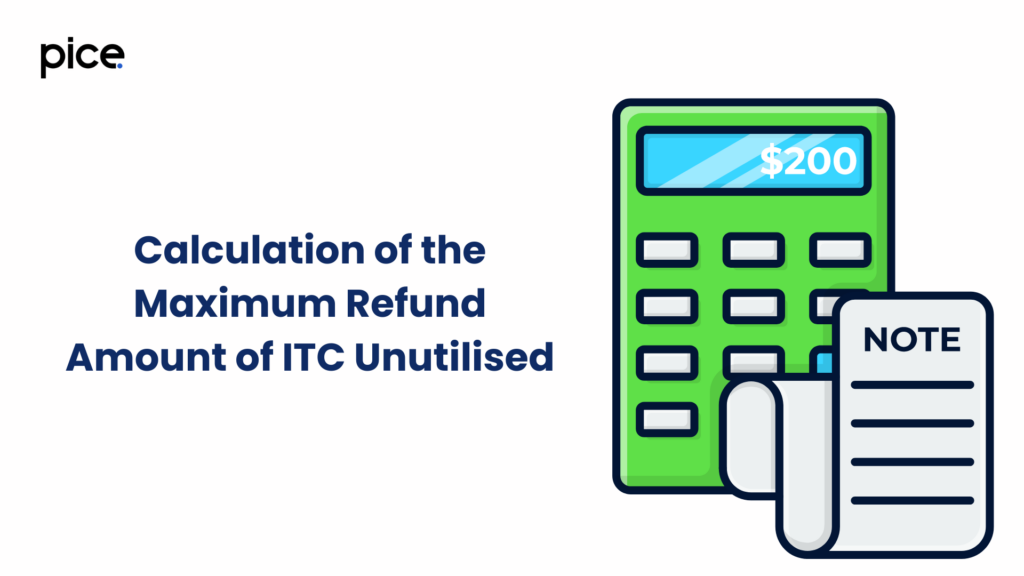

Calculation of the Maximum Refund Amount of ITC Unutilised

To calculate the maximum refund amount of unutilized ITC for GST refund applications, follow these steps:

1. Identify Eligible ITC

- Ensure ITC pertains to inputs and input services used for zero-rated supplies (exports).

2. Determine the Relevant Period

- Define the tax period for which the refund is claimed.

3. Calculate Net ITC

- Total ITC on inputs and input services for the relevant period.

4. Ascertain Turnover of Zero-Rated Supply

- Turnover from exports and supplies to SEZ units.

5. Compute Adjusted Total Turnover

- Sum of zero-rated supply turnover and domestic taxable supply turnover.

6. Calculate Refund Amount

Use the formula:

Refund Amount = Turnover of zero-rated supply × Net ITC /Adjusted Total Turnover

GST Refund Process

- Application Submission: Refund applications are submitted through FORM GST RFD-01 on the GST portal.

- Acknowledgement: An acknowledgment in FORM GST RFD-02 is issued within 15 days from the date of application.

- Processing Time: The proper officer must process the refund application within 60 days from the date of receipt of the complete application.

- Provisional Refund: 90% of the total refund claim may be granted provisionally within 7 days from the date of acknowledgment.

Steps to Claim ITC Refund

To claim an ITC refund on the cancellation of GST registration, the following steps should be followed:

Step 1: Filing the Application for Cancellation

- Log in to the GST Portal: Access the GST portal using your credentials.

- Navigate to the Services Tab: Go to ‘Services’ > ‘Registration’ > ‘Application for Cancellation of Registration’.

- Fill in the Details: Provide details such as the reason for cancellation, desired date of cancellation, and upload necessary documents.

- Submit the Application: After filling in the details, submit the application for cancellation.

Step 2: File the Final Return

- Form GSTR-10: The registered person must file a final return using Form GSTR-10 within three months of the date of cancellation or the date of order of cancellation, whichever is later.

Step 3: Filing the Refund Application

- Form RFD-01: File the refund application using Form RFD-01 through the GST portal.

- Provide Necessary Details: Fill in the required details, such as the amount of ITC to be claimed, reasons, and supporting documents.

- Submit the Application: Submit the filled-out application form along with the required documents.

Step 4: Refund Processing

- Tax Officer Verification: The tax officer will examine the refund application. The officer may request additional information or documents if necessary.

- Approval of Refund: Once verified, the tax officer will approve the refund, and the amount will be credited to the bank account mentioned in the application.

Declarations and Annexures to be Submitted for Refund Application

When submitting a GST refund application for unutilized ITC, several declarations and annexures must be included to ensure compliance and smooth processing. Below are the key components:

Declarations

- Declaration under Rule 89(2)(f)

- Purpose: To declare that there is no unjust enrichment.

- Content: This declaration confirms that the refund claimed does not exceed the amount actually incurred and that no undue benefit has been gained.

- Declaration under Rule 89(2)(g)

- Purpose: To declare the correctness of the claim.

- Content: This declaration verifies that all details provided in the refund application are accurate and true to the best of the applicant's knowledge.

Annexures

- Annexure-B: Statement of Invoices

- Purpose: To provide a detailed list of invoices related to the refund claim.

- Content: Includes invoice numbers, dates, taxable value, tax paid, and the amount of ITC claimed. This annexure supports the refund claim with documentary evidence.

Cases When Provisional Refund is Allowed and Conditions

A provisional refund of 90% of the claim amount is allowed in cases of zero-rated supplies. The provisional refund is granted within 7 days of the acknowledgment of the refund application, subject to the condition that the claimant has not been prosecuted for any offense under GST law.

Situations for Payment of Refund to the Applicant

Refunds under the Goods and Services Tax (GST) regime are a critical aspect of compliance and cash flow management for businesses. Here are the detailed situations under which refunds are paid to the applicant:

- Application is Complete:

- Necessary Documents and Declarations Submitted: The applicant must ensure that all required documents and declarations are submitted correctly. This includes the refund application form (such as FORM GST RFD-01), supporting invoices, shipping bills for exports, and any other pertinent documents as outlined in the GST rules.

- Electronic Filing: The application should be filed electronically on the GST portal, ensuring all mandatory fields are duly filled.

- Verification is Satisfactory:

- No Discrepancies Found: During the verification process, the tax authorities will scrutinize the refund application and the supporting documents. If there are no discrepancies or mismatches, the refund process can proceed smoothly.

- Positive Verification Report: The tax authorities' verification report ought to attest to the accuracy and compliance of all of the applicant's information with GST regulations.

- No Dues:

- Outstanding Dues Cleared: The applicant must have no outstanding dues with the tax department. This includes any pending taxes, interest, penalties, or late fees. The tax authorities will check the applicant’s tax ledger for any dues before processing the refund.

- Compliance with GST Returns: The applicant must be compliant with the filing of all GST returns (e.g., form GSTR-1, GSTR-3B, GSTR-9) up to the date of the refund application.

Conclusion

Claiming an ITC refund on the cancellation of GST registration involves several steps and requires careful attention to detail. By following the outlined steps and ensuring all necessary documents are submitted, businesses can efficiently claim their refunds and settle any pending liabilities. For any specific issues or queries, it is advisable to consult a tax professional to ensure compliance with GST laws and regulations.

By including these detailed steps and considerations, businesses can ensure a smooth process when claiming ITC refunds on the cancellation of their GST registration.

💡Facing delays in GST payment? Get started with PICE today and streamline your GST payments. Click here to sign up and take the first step towards hassle-free GST management.

By

By