Can we claim GST on refrigerators in India?

- 20 Sep 24

- 12 mins

Can we claim GST on refrigerators in India?

Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax levied on every value addition. Understanding the various GST rates is crucial for both consumers and businesses, as it affects pricing, profitability, and compliance.

Overview of GST Rates in India

Goods and Services Tax (GST) in India is structured into multiple tax slabs designed to categorize different goods and services based on their nature and necessity. The GST system has five primary tax rates: 0%, 5%, 12%, 18%, and 28%. Let's break down each of these rates and their significance.

0% GST Rate

- The 0% GST rate applies to essential goods and services that are crucial for daily life and welfare. These typically include basic food items like fresh fruits and vegetables, milk, and cereals. The rationale behind this rate is to keep essential goods affordable for everyone, ensuring that basic needs are met without a tax burden.

5% GST Rate

- The 5% GST rate is applied to slightly more processed or less essential goods compared to those under the 0% rate. This category includes items like packaged food products, coal, and certain medications. This rate helps maintain affordability while generating some revenue for the government.

12% GST Rate

- The 12% GST rate covers a wider range of goods, including processed foods, certain types of clothing, and industrial machinery. This rate balances affordability with the need for moderate revenue generation. It's designed to tax goods that are more processed or higher in value than those taxed at 5%.

18% GST Rate

- The 18% GST rate is one of the most commonly applied rates, encompassing a broad spectrum of goods and services. Items like hair oil, toothpaste, soaps, and most consumer electronics fall under this category. The impact on consumers is moderate, and for businesses, it requires accurate accounting to claim input tax credits.

28% GST Rate

- The highest GST rate of 28% is reserved for luxury items and products considered non-essential. This includes high-end cars, tobacco, and aerated drinks. The purpose of this high rate is to generate significant revenue from non-essential and luxury items, while also potentially curbing the consumption of certain goods like tobacco.

Purpose of Having Multiple GST Rates

The multi-tier GST structure is designed to create a balanced tax system that can address the needs of a diverse economy. By categorizing goods and services into different slabs, the government aims to:

- Keep essential items affordable for all income groups.

- Generate necessary revenue without overburdening consumers.

- Encourage or discourage the consumption of specific goods through tax incentives or deterrents.

What is HSN Codes?

Harmonized System of Nomenclature (HSN) codes are used to classify goods systematically. These codes are crucial in determining the applicable GST rate for different products, ensuring uniform taxation across the country.

GST Rates and HSN Code for Refrigerators

Refrigerators, as a common household appliance, fall under specific HSN (Harmonized System of Nomenclature) codes, which determine their applicable GST rates. Knowing these codes and rates is crucial for both consumers and businesses to ensure compliance and correct pricing.

HSN Code for Refrigerators

- The HSN code for refrigerators is 8418. This code covers a range of refrigerating or freezing equipment, including household refrigerators and freezers.

GST Rate for Refrigerators

- The GST rate for refrigerators typically falls under the 18% slab. Below is a detailed table summarizing the GST rates and HSN codes for refrigerators and related items.

| Description | HSN Code | GST Rate |

|---|---|---|

| Household refrigerators and freezers | 8418 | 18% |

| Commercial refrigerating equipment | 8418 | 18% |

| Freezers and other refrigerating equipment | 8418 | 18% |

GST Impact on Electronics

The Goods and Services Tax (GST) is a comprehensive tax regime implemented in many countries, including India, to streamline and simplify the tax structure. The impact of GST on the electronics industry can be significant, affecting various aspects such as pricing, supply chain, and overall market dynamics. Here's an overview of the GST impact on electronics:

Pricing and Cost Structure

- Uniform Tax Rate: GST replaces multiple taxes like VAT, service tax, and excise duty with a single tax rate. For electronics, this can lead to a more uniform tax structure across states.

- Tax Rates: Depending on the specific product, electronics may fall under different GST slabs (e.g., 18%, 28%). High-end electronics like smartphones, laptops, and TVs may see changes in their final prices due to the applicable GST rate.

- Price Reduction: The elimination of cascading tax effects (tax on tax) can lead to a reduction in overall costs, potentially lowering the prices for consumers.

Supply Chain Efficiency

- Streamlined Logistics: GST encourages the creation of a unified market, reducing the need for multiple warehouses in different states to avoid state-level taxes. This can enhance supply chain efficiency and reduce logistics costs.

- Inventory Management: With a simplified tax system, businesses can manage inventory more effectively, leading to better availability of electronics products and potentially lower costs.

Impact on Manufacturers and Retailers

- Input Tax Credit (ITC): Manufacturers and retailers can claim ITC on the GST paid on inputs, reducing the tax burden and improving profitability. This can also lead to competitive pricing in the market.

- Compliance Costs: While GST simplifies the tax system, it also requires businesses to comply with new regulations and maintain detailed records, which can increase administrative costs, especially for small and medium enterprises (SMEs).

- Affordability: Lower prices due to reduced tax burdens and improved supply chain efficiency can make electronics more affordable, potentially boosting demand.

- Market Dynamics: Changes in pricing and product availability can influence consumer preferences and buying patterns, leading to shifts in market dynamics.

Challenges and Considerations

- Initial Adjustment: The transition to GST can be challenging for businesses due to changes in accounting systems and compliance requirements. There may be short-term disruptions as the industry adjusts to the new tax regime.

- Rate Fluctuations: Any changes in GST rates by the government can impact pricing strategies and market stability. Businesses need to stay adaptable to such changes.

Long-term Benefits

- Increased Transparency: GST promotes transparency in the tax system, reducing tax evasion and corruption. This can lead to a more robust and trustworthy market environment.

- Economic Growth: By simplifying the tax structure and reducing costs, GST can contribute to the overall growth of the electronics industry, fostering innovation and competitiveness.

Benefits of GST on Electronic Items

The implementation of the Goods and Services Tax (GST) has had a considerable impact on electronic items, bringing several benefits to the industry and consumers.

Uniform Tax Rate:

- Simplification: GST replaced multiple indirect taxes like VAT, excise duty, and service tax with a single uniform tax, simplifying the tax structure.

- Price Transparency: A uniform tax rate makes pricing more transparent and predictable for consumers.

Reduction in Prices:

- Input Tax Credit: Manufacturers and retailers can claim input tax credits, reducing the overall tax burden and allowing for price reductions.

- Cess Rates: The introduction of cess on certain luxury items ensures that basic and essential electronics remain affordable.

Increased Efficiency:

- Supply Chain Optimization: With the removal of state-specific taxes, companies can optimize their supply chains, reducing costs and improving efficiency.

- Reduction in Logistics Costs: Unified taxation reduces the need for multiple warehouses across states, leading to lower logistics costs.

Boost to Consumption:

- Price Cuts: Reduced prices due to lower tax burdens increase affordability, boosting consumption and demand for electronic items.

GST Rates on Consumer Appliances

Refrigerators:

- GST Rate: Refrigerators are generally taxed at 18% under GST.

- Impact: This rate may result in a slight increase or decrease in prices, depending on the previous tax rates applied in different states before GST implementation.

Washing Machines:

- GST Rate: Washing machines also fall under the 18% GST slab.

- Impact: Similar to refrigerators, the uniform tax rate can lead to price adjustments, making it easier for consumers to understand and anticipate costs.

Annual Growth Rate and Industry Impact

Consumer Appliances:

- Growth: Following the implementation of the GST, the consumer appliance industry has experienced a steady annual growth rate.

- Market Dynamics: The GST regime has contributed to a more competitive market, encouraging innovation and improved product offerings.

Specific GST Rate Revisions and Impact

Biggest GST Rate Cut:

- Reduction of Price: Significant rate cuts on certain electronic items have led to noticeable price drops, benefiting consumers directly.

Effective Date Rate Revision:

- Price Stability: Revisions to GST rates are effective from specific dates, helping businesses plan and adjust pricing strategies accordingly.

Price and Market Adjustments

A Price Drop:

- Consumer Benefit: Many electronic items experienced price drops due to reduced tax burdens, making high-end products more accessible.

- Price Increase: In some cases, the GST rate may have resulted in a slight price increase, but the advantages of input tax credits and supply chain efficiencies typically offset this.

Industry-Specific Impact

Kitchen Appliances:

- Reduced Prices: GST has led to more competitive pricing in the kitchen appliance segment, benefiting consumers with better deals.

Domestic and Electronic Appliances:

- Price Cuts and Adjustments: The uniform GST rate across states ensures consistent pricing, aiding in the growth of the domestic appliance market.

Retail Prices:

- Stabilization: GST has helped stabilize retail prices, making electronic items more affordable and predictable for consumers.

Can We Claim GST on Refrigerator?

Yes, you can claim GST on a refrigerator, but it depends on the context of the purchase and the nature of your business. Here's a detailed explanation:

Claiming GST on a Refrigerator

For Business Use:

Input Tax Credit (ITC): If you are a business registered under GST and the rate on refrigerator is used for business purposes (e.g., in a company pantry, office kitchen, or for storing products), you can claim the GST paid on the refrigerator as an Input Tax Credit (ITC).

Conditions for Claiming ITC:

- Registered Business: The business must be registered under GST.

- Use for Business: The refrigerator should be used for business purposes.

- Tax Invoice: You must have a valid tax invoice from the supplier showing the GST amount.

- Filing Returns: The business should have filed the necessary GST returns.

For Personal Use:

No ITC: If the refrigerator is purchased for personal use, you cannot claim the GST paid on it as an Input Tax Credit. GST benefits are available only for goods and services used for business purposes.

Steps to Claim GST on a Refrigerator for Business Use

- Purchase from a GST-Registered Supplier:

Ensure that you buy the refrigerator from a supplier who is registered under GST and provides a proper tax invoice.

- Obtain a valid tax invoice:

The invoice should include the supplier's GSTIN, your GSTIN, the description of the refrigerator, the value of the goods, the GST amount, and other relevant details.

- Record the purchase:

Record the purchase in your accounting system, ensuring that the GST amount is properly accounted for.

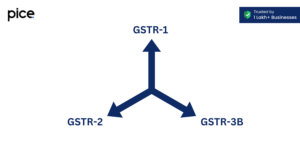

- File GST returns:

Include the ITC claim in your GST returns (GSTR-3B and GSTR-2A). Ensure all required documentation is maintained and filed correctly.

- Maintain Documentation:

Keep all invoices and records of the purchase, as they may be required for verification by tax authorities.

Conclusion

Understanding GST rates is vital for navigating the complexities of the tax system in India. The various rates, from 0% to 28%, ensure that the tax burden is distributed equitably based on the nature of the goods and services. For the electronics sector, GST has brought significant benefits and challenges, making it crucial for both consumers and businesses to stay informed and compliant.

💡Facing delays in GST payment? Get started with PICE today and streamline your GST payments. Click here to sign up and take the first step towards hassle-free GST management.

By

By